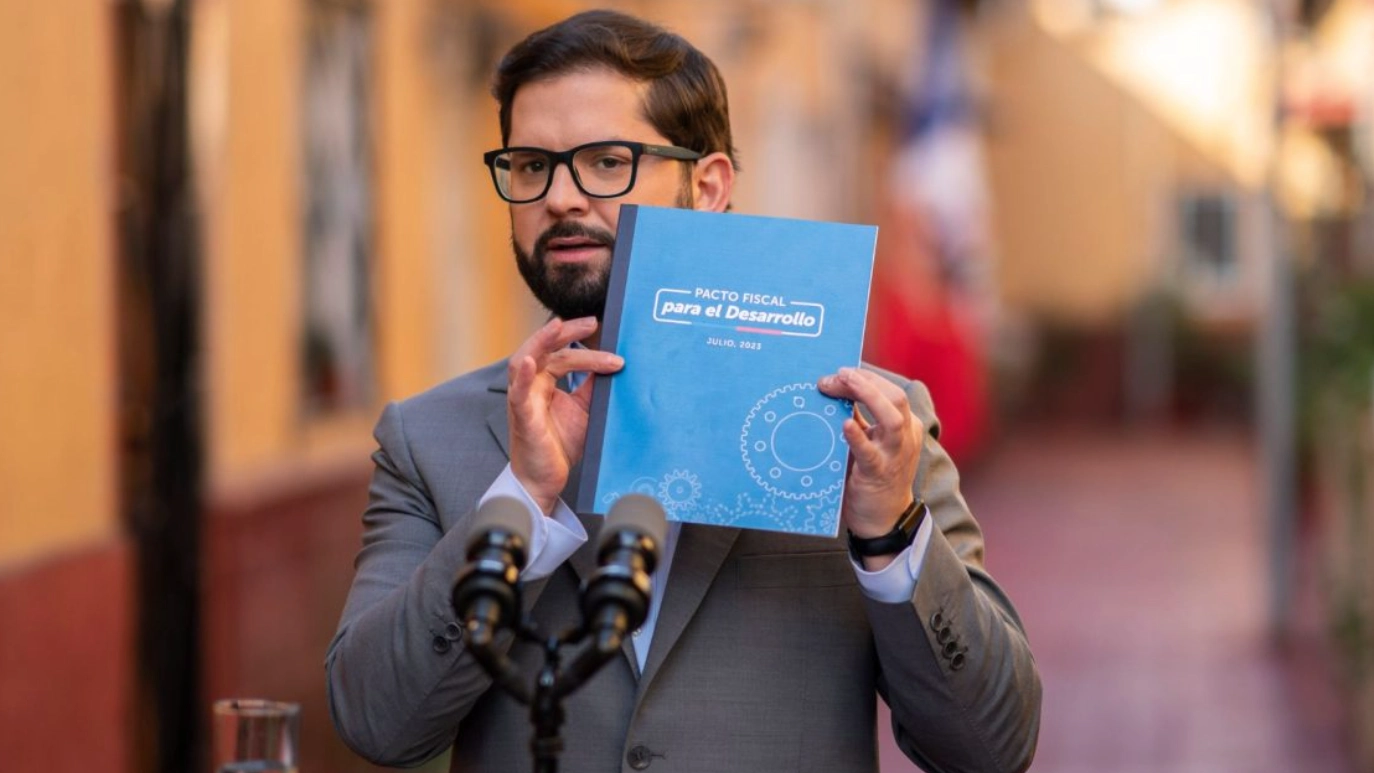

On August 1, the President of Chile, Gabriel Boric, announced the so-called “Fiscal Pact for Development” that will be implemented in his country. Given that social spending needs to be financed and financial resources are finite, the proposal incorporates a set of actions for sustainable growth, efficiency in public management, and fiscal responsibility.

The pact defines the principles for a modern tax system; spending needs and priorities; reform commitments to strengthen transparency, efficiency, and quality of state services; boost growth through investment, productivity, and formalization of the economy; strengthen tax administration and income tax reform; and institutional mechanisms for follow-up, monitoring, and evaluation of the Fiscal Pact.

Within the principles, the so-called tax justice refers to increasing taxes for those with higher incomes (vertical progressive taxes), taxing equally those with similar incomes (horizontal taxes), and reducing tax avoidance (avoiding taxation through legal arguments).

In terms of spending priorities, the plan seeks to increase spending on social material by an amount equivalent to 2.7% of GDP in highly sensitive areas such as pensions, health, social protection, and public safety. The main goals to be achieved are the increase in the Universal Guaranteed Pension by a little more than 20%, as well as the possibility of reducing waiting lists for surgical care and medical specialties.

Regarding the reform of the state, the plan aims to improve public programs through the creation of an Agency for the Quality of Public Policies. It also seeks to establish a regulatory framework to regulate transfers to NGOs and foundations, allow MSMEs access to the government procurement system, use digital systems to detect anomalies in public spending, and establish strong fiscal discipline at all levels of government.

As measures to boost growth, it seeks to grant tax incentives, reduce the processing of investment projects, encourage research and development by companies, encourage green economic activities, and reduce economic informality. In the tax area, the aim is to educate taxpayers, provide benefits to the middle class, have a tax system for SMEs, and focus taxes. And finally, a Follow-up and Evaluation Commission will be created to monitor and evaluate the results after 3 and 5 years of the plan’s implementation.

In the social area, the Fiscal Pact aims to improve social welfare, particularly for the most economically disadvantaged groups, as well as socially excluded groups such as the elderly, the disabled, and caregivers. The plan, however, still fails to address the core problem of the performance of the Pension Fund Administrators (AFP) and the saturation and coverage of the healthcare system, both public and private.

In terms of production, the aim is to strengthen micro, small, and medium-sized enterprises through incentives, since they are the main sources of employment generation and concentration. It also aims to tighten informal activity, tax imports, and penalize digital commerce, elements that are used by micro and small enterprises to provide inputs for their operations and as marketing channels.

In terms of productive diversification, the focus continues to be on extractivist activities with an emphasis on mining, in addition to the fact that the modification of the Environmental Impact Assessment System and the granting of Maritime Concessions could generate undesired effects in environmental terms, such as the proliferation of projects with negative externalities, the intensity of water use or new sacrifice zones.

Incentives for research and development in a country that is concentrated in the tertiary sector and where the manufacturing industry is less than 10% of GDP, is a complex issue. In addition, priority should also be given to public higher education institutions, which currently concentrate on the critical mass of researchers in the country, since there could be a migration from the academic world to the business world, affecting the quality of higher education and specialization.

Economic formalization has a large cultural component since it is customary to hire personal services such as maintenance or construction without a contract, and therefore without the corresponding contribution of taxes and social security and retirement taxes. Beyond the education of taxpayers, a change in social behavior is necessary to allow the transition to formality in all economic activities. On the other hand, when there is talk of increasing taxes on high incomes, who are they thinking of? In which income brackets? Legal entity and natural persons?

To conclude, two elements must be highlighted. The first one is the economic growth projections. According to the Central Bank low growth is expected for this year (between -.5% and 0.25%), between 1.25% and 2.25% in 2024, and between 2 and 3% for 2025. This may limit both public revenues and expenditures.

The second aspect that may play against the proposal is the timing. The income tax reform is expected to enter the National Congress by 2024, as well as the processing and dispatch of the remaining pro-growth and state reform projects. The discussion and reaching of political agreements could be delayed until the end of the current government or the beginning of the next one, where priorities could be different, which would give a new turn to several points of the fiscal pact.

*Translated from Spanish by Janaína Ruviaro da Silva